The Market Day Supply (MDS) score, a fundamental metric!

16 oktober 2025, PaulWhy we use data from Indicata

Even though we only have a small store, we use data to determine the value of trade-in and sales cars. We do this using data from Indicata • Netherlands. We use this data to stay on top of our inventory cars, but also for bidding on trade-ins.

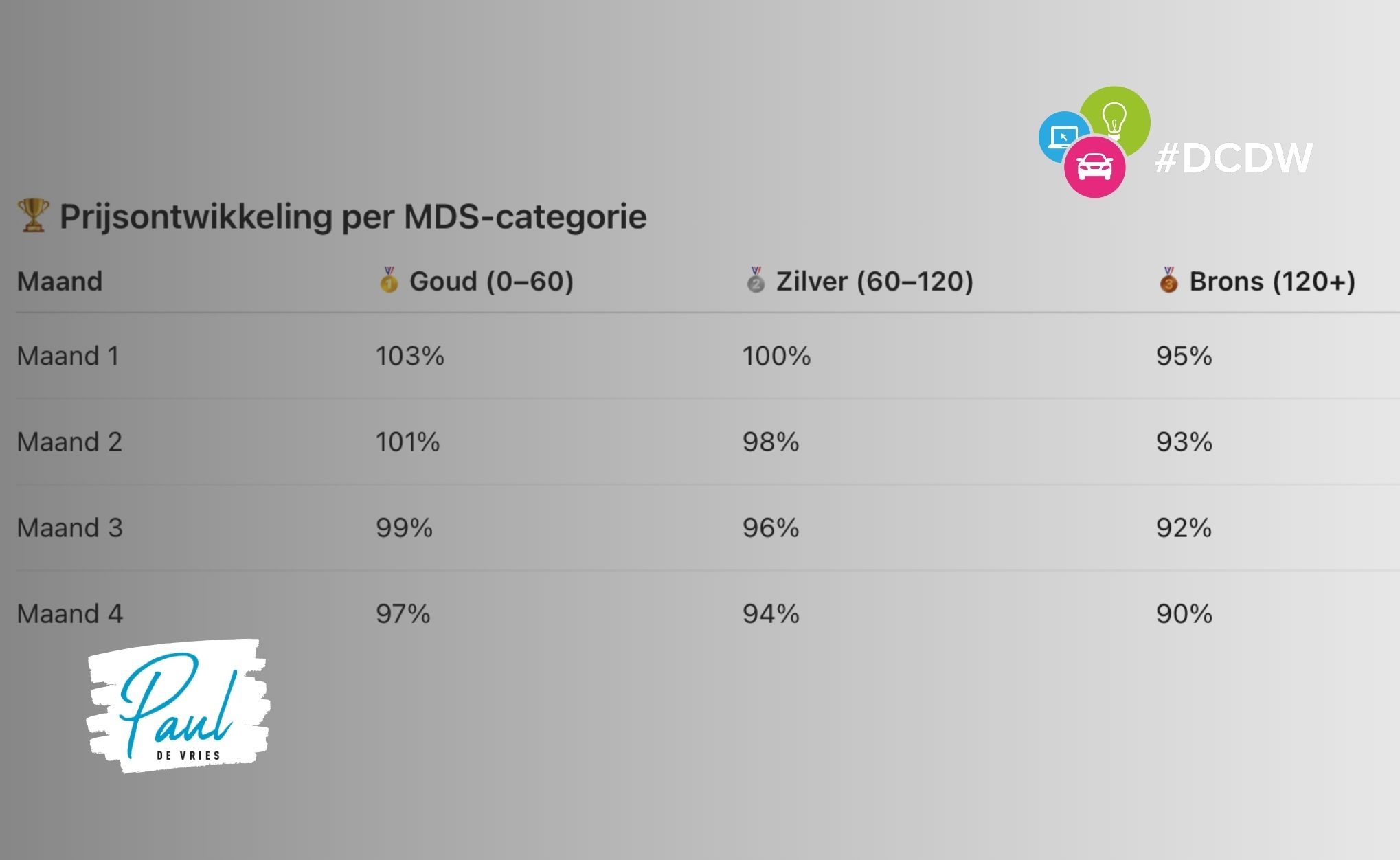

Our strategy is as follows: we divide the cars into three buckets: gold, silver, and bronze.

The cars in the gold bucket have an MDS score of 0–60 days. This means a Market Day Supply that suggests you can sell the car within 60 days with the right market strategy. Together with Indicata, we’ve implemented this strategy in their software. For another company, the gold score might be 0–30 days. Then we have the silver cars, with an MDS of 60–120 days. The bronze cars are those with an MDS of 120 days or more.

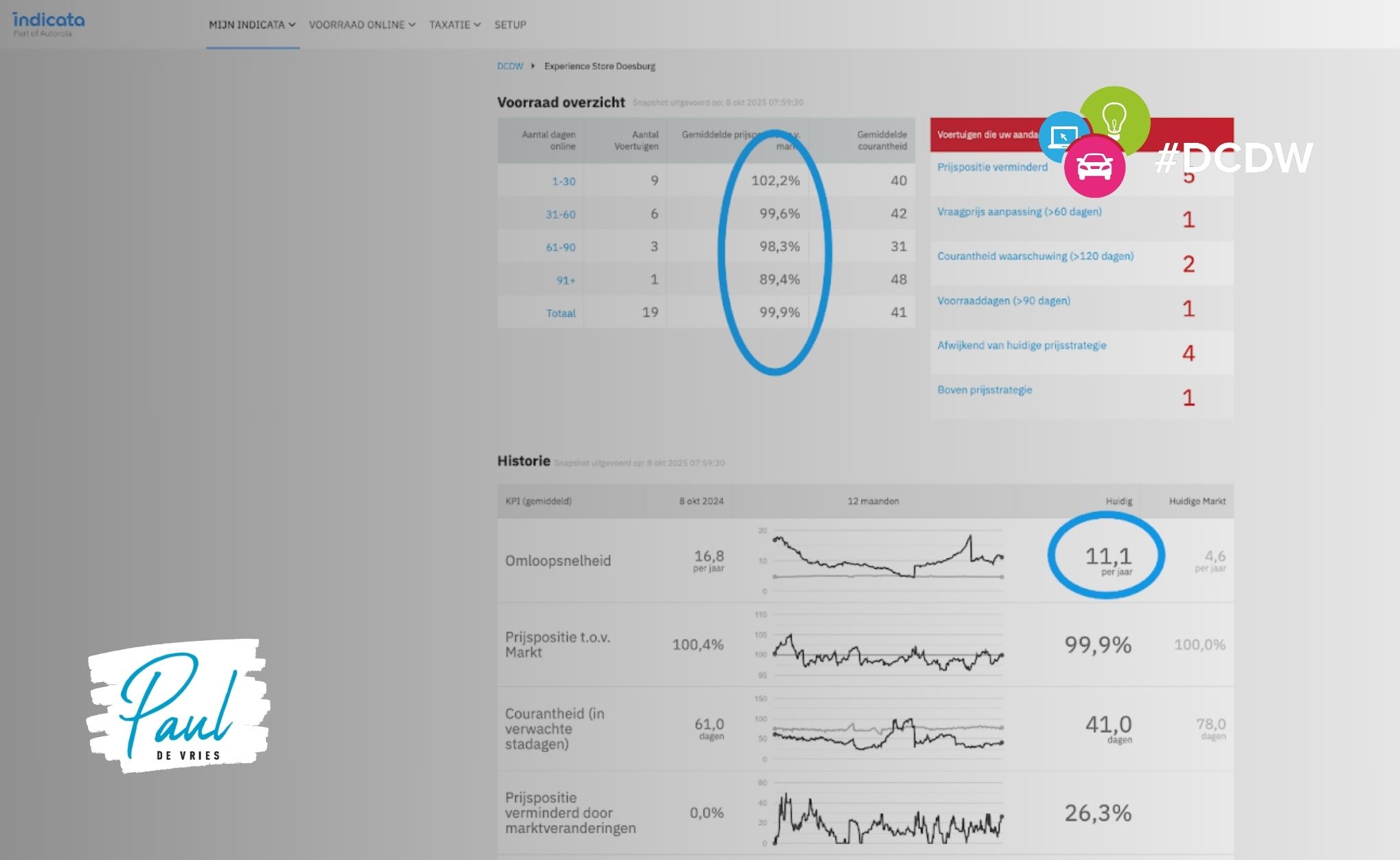

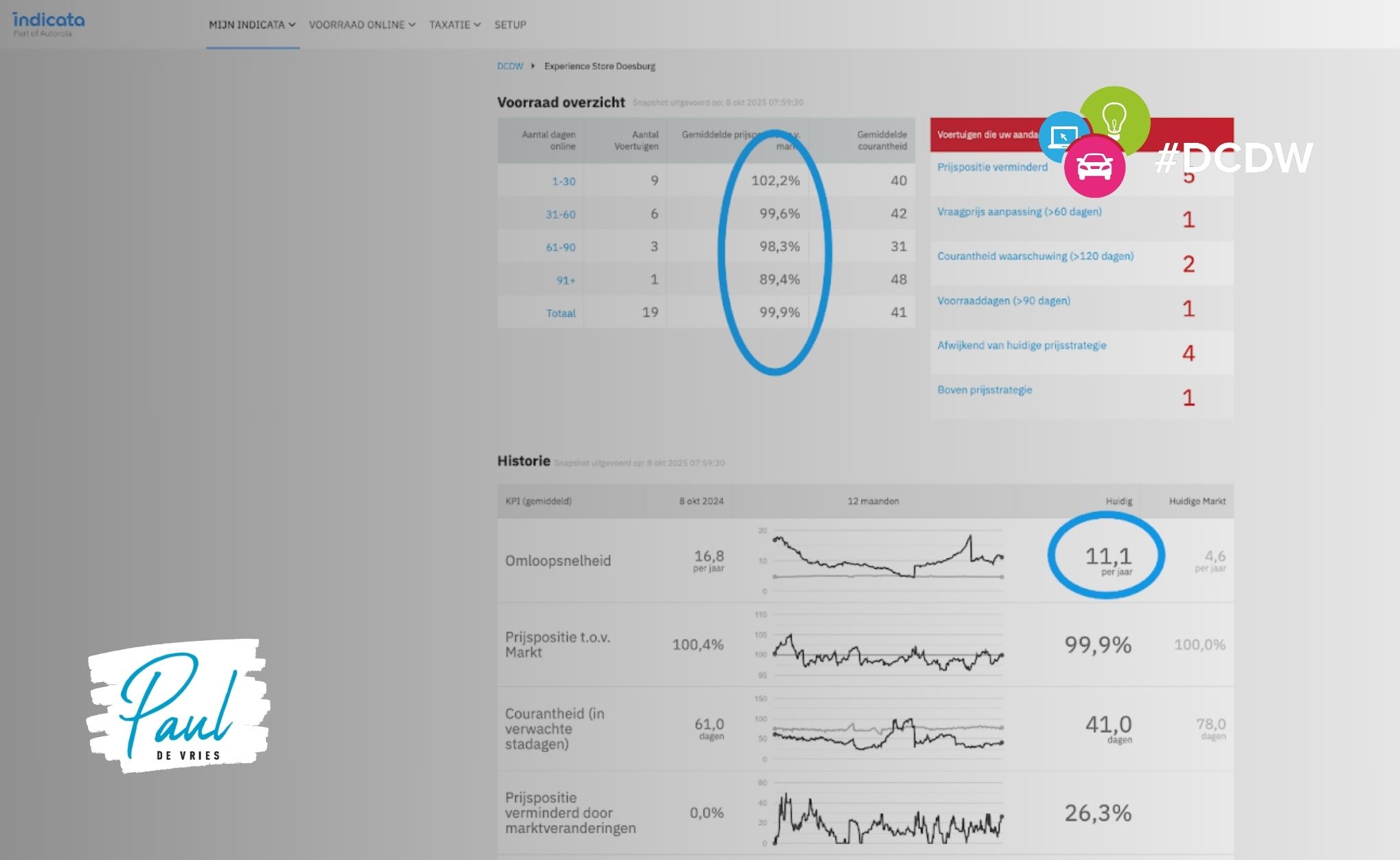

A snapshot of my current inventory

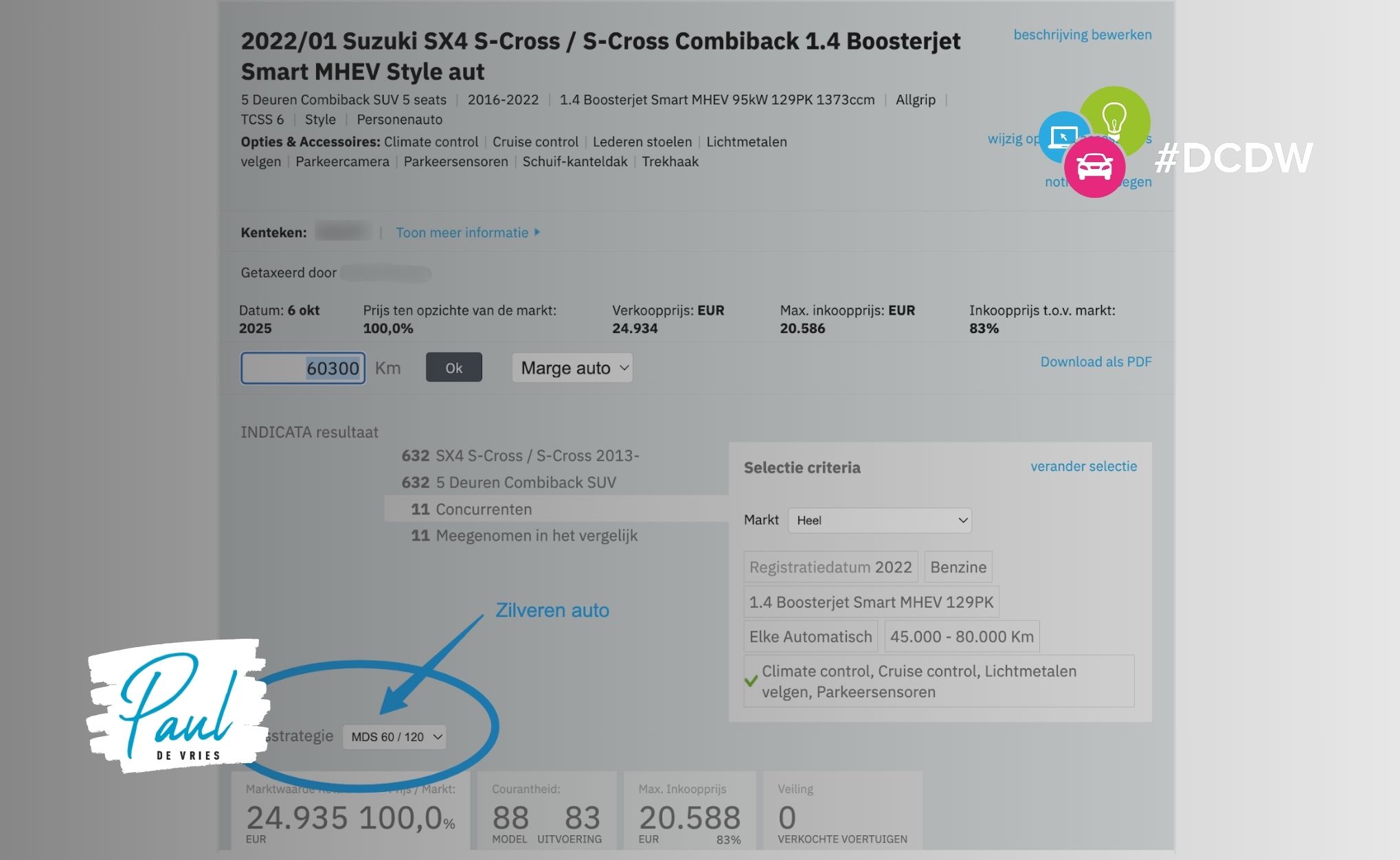

When buying cars, of course, you only want the gold cars. However, if that gold car has a price index of 100% but you can only buy it at 105%, then it may have a good MDS but will stay in stock longer due to the high price. So, MDS alone does not indicate sellability; the purchase price must also be market conform.

For purchasing, I try to buy only gold cars at the right price. When it comes to trade-ins, I have less control. My inventory therefore consists of gold, silver, and bronze cars.

When I have to take a car in as a trade-in, I immediately see the MDS score—and thus whether it is a gold, silver, or bronze car.

For a gold car, I start above the 100% index, at 103%. The MDS is low, so there is high demand, justifying a higher price. If the car hasn’t sold after a month, I lower the price to 101%. After two months, to 99%, and after three months, to 97%.

In other words: start higher because it’s a gold car, but adjust if the market—or turnover—requires it. The car still has demand, but the price decreases with the market. By month four, I aim for 97% relative to the current market price. This may result in higher depreciation than the original asking price.

The same applies to silver and bronze cars. For example, if I trade in an old Seat Ibiza with an MDS of 120+ (a bronze car), and the market price is €10,000, I immediately ask 95%, so €9,500, to ensure the car—where demand is low—sells quickly, ideally within 30 days to keep turnover at 12.

Conclusion

Ultimately, my goal is to make more money from the inventory I have. In my current situation—starting out, three years in—I prefer turnover over maximum margin per unit. I’d rather earn €1,250 three times than €3,000 once. It requires more work, but I need to ensure my money works and keeps returning. You can also see this in the chart I get from Indicata.

It shows that my pricing strategy is followed fairly well. However, the cars are not divided into gold, silver, and bronze, but by turnover buckets. My turnover is 11.1, while the market average is 4.8. My goal is at least 12, so I’m not there yet!

On the other hand, Indicata says my inventory stays in stock for an average of 41 days. This requires action from me! After all, I still want Hans Kraayenveld to approve my approach…

Above you can see how to work with data. This is just one method, which I still need to align with my colleagues so that we know—also physically—which cars we have (gold, silver, bronze) and what the pricing strategy is.

What makes it harder for us are the rounded prices: everything is rounded to €1,000. Adjustments don’t happen in small steps but in thousands. The index goes from 103% to, for example, 99%. We still need to fine-tune this, but that’s also the fun: it’s never finished. By following the data, you gain control over your inventory and pricing.